The futures prop trading scene keeps shifting, and in April 2025, FundedNext made its move, stepping beyond CFDs and Forex into major futures markets. Many traders paid attention because funding in the futures space brings a very different game compared to leveraged spot trading.

Here, slippage, tick value, and the emotional weight of the drawdown matter just as much as your entry signal. FundedNext has built two distinct evaluation routes, a selection of platforms, and an internal rulebook that traders either see as a useful framework or a leash that limits creativity. This review looks at every detail, so you can see what they have to offer.

Overview of FundedNext Futures

FundedNext operates under GrowthNext F.Z.E. and runs its proprietary futures program through simulated accounts. The evaluation and funding process is managed by entities registered in Comoros, with a service office in Cyprus. There is no direct futures market regulator overseeing the program, so traders operate entirely within the firm’s own rules. That means adapting to the way FundedNext defines discipline is just as important as your market analysis.

Payouts are based on your simulated performance rather than orders sent to a live brokerage. Every win and loss exists within its controlled environment, so your results are judged on how well you follow the challenge framework. The program offers two evaluation models, Rapid and Legacy, each with its own profit targets, risk limits, and funding process. KYC checks are mandatory before anyone touches a funded account.

By July 2025, traders in Iran, North Korea, Ukraine, Sudan, Syria, and other restricted regions found the doors shut, largely due to sanctions and compliance measures. Some countries outright ban proprietary trading, so knowing your local laws before joining is essential. Participants must be at least 18 years old, and those who succeed here usually treat the rules as the “real market” they have to beat.

Evaluation Models of FundedNext Futures

FundedNext runs its futures program through two evaluation models: the Rapid Challenge and the Legacy Challenge. Both lead to a funded account, but the path feels very different depending on which one you choose.

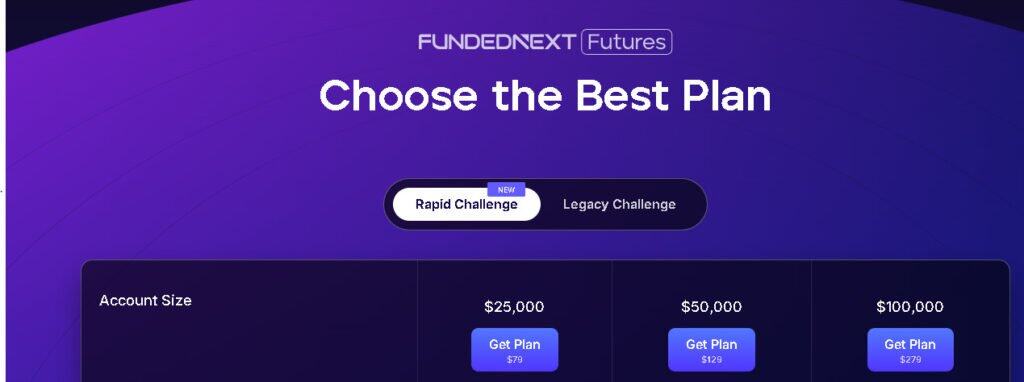

Rapid Challenge

The Rapid Challenge is designed for traders who want more freedom. There’s no daily loss limit and no countdown to complete the challenge. You could, in theory, hit the profit target in a single strong session if the market lines up. The drawdown is trailing and follows your highest balance, calculated at the end of the trading day. Once you hit the profit target, that trailing drawdown locks in place.

There’s no consistency rule in the evaluation phase, which means you can take most of your profit in one big trade without penalty. Account sizes are $25,000, $50,000, and $100,000, with profit targets of $1,500, $3,000, and $5,000. Entry fees are $59, $99, and $249.

Passing the evaluation gets you a funded account, but the freedom tightens. The funded stage introduces a 40% consistency rule, fixed drawdown, maximum loss limits, and mandatory end-of-day flat positions. All trades must be closed by the end of the trading day, and KYC is fully enforced.

Legacy Challenge

The Legacy Challenge is more structured. It adds a daily loss limit alongside a trailing drawdown and keeps the 40% consistency rule in place from the start. This can frustrate traders who rely on big one-off moves but rewards those with steady, measured performance.

Account sizes match the Rapid Challenge, but the profit targets are slightly lower at $1,250, $2,500, and $6,000. Prices are $129, $249, and $449. There’s no set deadline to finish, so you can work at your own pace.

Passing this model puts you into a funded account with the same restrictions as the Rapid model. One added perk: Legacy traders who withdraw at least 10% of their funded account size receive a one-time 15% bonus.

Both models demand discipline. Choosing between them depends on whether you perform better with open freedom or with rules that guide every decision.

Features of FundedNext Futures

FundedNext Futures comes with a set of features that can fit both fast-moving traders and slower, more deliberate ones, such as;

- Trading Platforms: Tradovate, NinjaTrader, and TradingView are all available, which is a plus since some futures prop firms force you into a single platform. The choice matters because execution speed, charting tools, and layout can make or break your trading rhythm.

- Education/Tools: There’s a trading guide, a set of blog articles, an economic calendar, and a few calculators. These won’t turn a losing strategy into a winning one, but they can sharpen your planning and keep you from being blindsided by market events.

- Market Access: The lineup covers the full CME suite; FX, equity futures, agricultural markets, COMEX metals, CBOT grains, and Dow Jones futures, plus NYMEX energy contracts. It is the kind of variety that lets a trader rotate between markets when one goes quiet, though it can also tempt you into spreading your focus too thin.

- Payment and Withdrawal Methods: Challenge fees can be covered with Visa, MasterCard, PayPal, Skrill, Apple Pay, and Google Pay, or in crypto with Bitcoin, Ethereum, Litecoin, Solana, Dogecoin, USDT, and USDC across ERC20 and TRC20. Payouts come through RiseWorks in USDT or USDC, which means you can skip the banking delays that kill momentum after a good run.

- Account Limits and Scaling: You can run multiple challenges at the same time as long as the combined total stays under $400,000. Traders who keep showing consistent profits can grow their allocation up to $1,000,000. That consistency requirement quietly eliminates the “all in, big win” crowd.

- Support and Community: Email and live chat are open all day, every day. The Discord server and X profile are busy enough that you can always find someone talking strategy or venting about rules. Like most trading communities, the quality of advice varies, so knowing how to filter the noise makes a big difference.

Pros and Cons of FundedNext Futures

Pros

- Guaranteed performance rewards are processed within 24 hours, with a $1,000 bonus if that window is missed, a rare payout promise in this space.

- Legacy Challenge traders receive a 15 percent performance bonus on profits once they start making withdrawals, which can be a nice extra if you are already trading well.

- No activation fees or ongoing subscriptions, just a one-time payment to enter the challenge.

- Performance rewards can be withdrawn every five days, and there is no cap once you pass the initial benchmark period.

- News trading is allowed in both the challenge and funded stages, giving more flexibility for traders who like to work around economic events.

Cons

- Limited account size options may frustrate traders wanting more variety.

- Everything is traded on simulated accounts, so fills and slippage won’t exactly match live markets.

- Strategies involving latency arbitrage, overnight holds, or weekend positions are banned.

- At least one trade must be placed every seven days in the challenge stage, which can push you into trades you wouldn’t normally take.

- Thirty days of inactivity in the funded stage can lead to losing your account entirely.

Final Takeaway

FundedNext Futures ultimately gives traders two clear routes to a funded account. The Rapid path allows more freedom during the evaluation, while the Legacy path builds structure from the very start. Both reward discipline in different ways, and both come with their own trade-offs once you are funded. Fast payouts, no recurring fees, and the option to trade around news events are strong advantages.

At the same time, the simulated environment and stricter funded-stage rules require you to adapt if you are used to open market conditions. For traders willing to approach the evaluation as its own market with its own rules, FundedNext can be a solid platform for trading the firm’s capital with terms you fully understand before your first order.