Why prop trading?

There are various reasons why traders use prop trading accounts. Typically, it revolves around the account size, which can be considerably higher than a trader may be able to fund themselves. However, the path to a fully capital funded account can be drawn out, and experience within the day or swing trading sector is without doubt beneficial.

Ultimately, there is no question that with a prop trading account, skilled traders can generate significant amounts.

Why is credibility so important when deciding which prop trading company to use?

One of the overriding elements of any decision you make regarding which prop trading company to work with should be credibility. Established firms with a consistent trading history, substantial numbers of positive reviews, and positive comments on social media all add weight to help you make an informed choice.

Be wary of offers that appear out of the blue and have no substance. Social media and AI have provided a breeding ground for potential prop firms with no back history or established track record to ply their offers all too easily.

Sponsored posts making offers that are simply too good to be true, and potentially to the detriment of the individual trader, are becoming the norm. As you would with stocks, ETFs, crypto, etc, DO your due diligence.

Previous and established historical trading/investment experience and lots of positive reviews always tell a story. Those prop firms without this sort of credibility, as the renowned Latin saying so ably describes, “Caveat emptor” = Buyer beware.

So who are Bulenox?

Bulenox is an investment company based in Wilmington, Delaware. Numerous reviews and testimonials expressed through social media channels such as Reddit, and traditional review organizations such as Trustpilot express general satisfaction and impressive attributes such as honesty, integrity, and quick and efficient customer service. In fact, within the aforementioned Trustpilot, Bulenox impressively achieves a 4.8-star rating with over 1200 reviews.

Bulenox specialises in futures and trading-funded accounts.

Bluenox, by its own admission, offers an innovative approach to prop trading. They provide a next-generation global platform that is specifically built by traders, enabling them to deliver an innovative platform based on the unique requirements of traders. The platform utilizes cutting-edge technology and has gained in-market notoriety for its state-of-the-art functionality.

Why Bulenox?

Impressive reviews, in significant numbers, although a good sign, are only the start of why Bulenox may well be suitable for you as a prop trader.

The question often relates to how the individual traders view the nuts and bolts of the Bulenox systems, for example, payment processes, user-friendly account setup and support, as well as reliability.

Recommended by established and renowned organisations such as Rithmic Trader and NinjaTrader, this adds considerable weight to the positive position of the prop trading option.

Payouts, once qualified, can be weekly, and Bulenox offers the initial $10,000 withdrawal as commission-free. Then they offer a 90%/10% split, with 90% to the trader.

How to start with Bulenox?

Bulenox’s onboarding is simple, with only 4 steps involved. Step 1 is the initial registration on their own website, which enables the user to select the account size, with no background check. The next step involves authorization, which includes downloading and installing the trading software as well as connecting your Bulenox trader’s account.

As with all prop trading accounts, qualification is a must. Bulenox provides a qualification account to enable the trader to develop the relevant skillset, which includes one key element: their risk management.

Qualification accounts

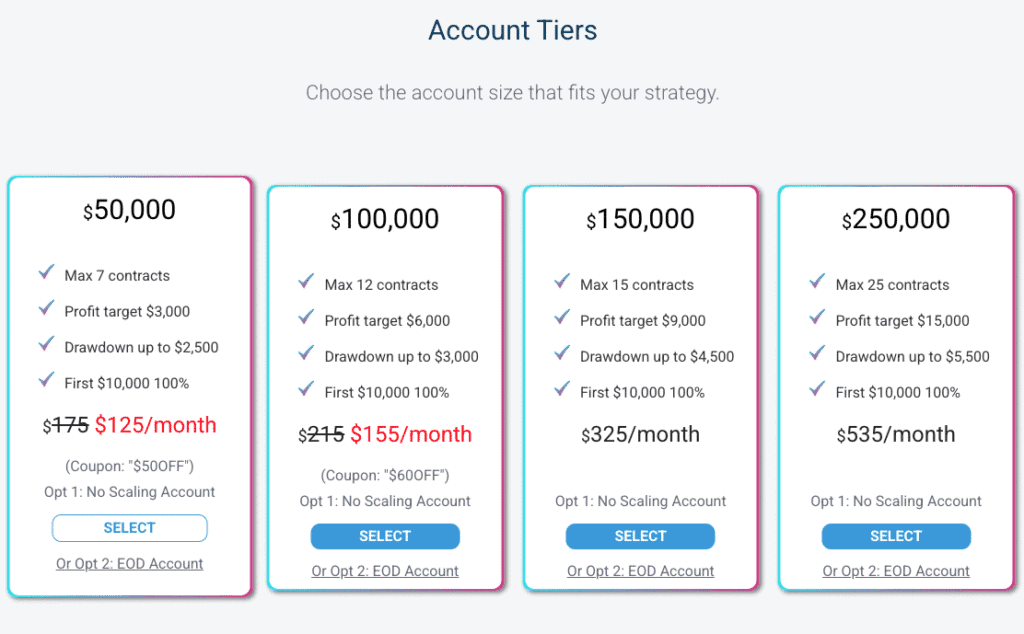

Bulenox offers a defined route to a funded account, which follows the typical prop trading firm qualification. It involves a qualification account, which, once successful, leads to a Master account, which, after specific criteria are met, can then lead to a funded account utilizing real capital.

The qualification account, which some call “challenge” accounts, offers two options: a no scaling/trailing down account and an EOD (End of day account.)

In the Trailing Drawdown model, the maximum loss limit adjusts dynamically as your account balance increases, so in essence, it “trails” behind your equity high-water mark. However, the drawdown does not move down when you lose money; essentially, it stays fixed at its last level. This is where you need to be careful because if the account balance falls below the trailing level, which also includes open trades, the account can fail.

The key points to remember are the inclusion of unrealised profits and losses. For example, if you are in a winning trade that retraces, it could hit your trailing stop level. Ideally, this type of model works best for short-term/intraday traders and scalpers, who close positions on the day, with no overnight or longer-term holds, where positions can fluctuate.

Risk management is key with this type of model; the stricter the better. Additionally it is cheaper to join.

The second qualification option with Bulenox is the EOD Drawdown model. This works by calculating your drawdown limit based on the closed balance only. This means it adjusts just once per day, not intraday. This also has the benefit of the fact that unrealised P/L (profits or losses) do not affect your drawdown during the trading day.

This type of model tends to be more favourable for swing and position traders, basically, anyone who prefers to hold positions longer than a day. There is no intraday equity tracking, and it offers more flexibility in terms of daily/intraday fluctuations.

This EOD model has higher activation/evaluation fees and offers slightly lower leverage options.

As with most prop firm qualification accounts, the option to reset is available. However, that is not an option for a Master account.

To activate a Master account, the qualification must be passed and an activation fee paid. The activation fee itself varies, based on the account size being requested.

The Master account sizes range from $25,000 up to $250,000, and likewise the fees range from $143 up to $898, dependent upon the size of the Master account.

It should be noted that traders can have multiple accounts; however, all must be under the same Rithmic Trader user ID.

The aim is to, of course, obtain and work with real capital, which is a funded account. To achieve this, the trader needs to complete three successful payouts under a Master account. Once this has been achieved, the account is reviewed by the risk management team, who have sole discretion in terms of activation of a funded account.

Once a funded account is activated, there are also additional criteria which need to be adhered to. For example, at the time of writing, balance caps are enforced on all funded accounts, which range from $2500 for a $25,000 funded account up to $25,000 for a $250,000, in essence, 10% of the funded account value. Bulenox will also consolidate all active Master accounts into a single funded account, apart from those that have not been activated.

Side Note:

Algo, Copiers and bots?

With the prevalence of AI and bots, Bulenox states on their website that they do not provide any algorithms; however, they also do not forbid their use. It does go on to say that, obviously, they cannot be held responsible for any issue, technical or otherwise, with third-party software.

RithmicTrader software

Bulenox offers the RithmicTrader pro trading software front-end developed by Rithmic, LLC. It delivers ultra-low latency market data and execution and is specifically designed for semi-professional and professional traders, especially in futures.

The app is a desktop app that runs on Windows, although it can be run on iMacs via the downloadable app or using software such as Parallels to create a virtual machine on your Mac. Alternatively, the web app accessible via a browser is also available alongside a mobile app version.

The software provides extensive functionality, including real-time quotes, order placement, trailing stops as well as bracket orders and more.

It has low latency, which means very fast order execution, which is essential in fast-moving, volatile stock trading. It also delivers direct market access (DMA) and includes real-time risk limits enabling robust risk management.

Other key features include Excel integration, charting with 100 built-in studies, as well as a stable and reliable trading software.

Payments

Bulenox offers weekly payments, usually on a Wednesday.

Once qualified and utilizing a funded account, payouts can be requested at any time during the month. All payouts are processed once a week, with requests required by the end of play on Friday for the following week’s payout.

There are, as you would expect, minimum, maximum withdrawal amounts as well as safety thresholds, all of which are directly related to the account size.

Although it should be noted that the maximum withdrawal amounts only apply to the first three payouts, and all caps are removed after the first three payouts.

The safety threshold is, as its name implies, the minimum amount that is required to be maintained within the account. This directly applies to payouts, in terms of the amounts available to withdraw must not reduce the account size to below the safety threshold, or the payment will not be processed.

There are also additional conditions which need to be met; these include that 10 individual trading days must be completed prior to making the first withdrawal request. In addition, Bulenox include what is termed a consistency rule, which states that no single trading day’s profit may exceed 40% of total profits since last payout (or since start), with no payout being processed until the situation is rectified, for example, more days/trades are added.

In terms of payouts, these can be made via ACH/Wire Transfer, PayPal, Zelle, or Crypto

Please note:

All information included within this review is correct at the time of publication. Changes made by the prop firm can be made without prior knowledge.