But first a quick overview of what prop trading is and how it works…

Proprietary trading, usually shortened to prop trading, is a trading model where individuals trade financial markets using a firm’s capital rather than their own money. Instead of funding a personal brokerage account, the trader operates under an agreement with a prop trading firm that provides access to capital and sets the rules under which that capital can be used. In return for access to this capital, the trader agrees to share a portion of any profits generated and to trade within strict risk limits. These limits typically define how much can be lost overall, how much can be lost in a single day, and how positions must be sized. The purpose of these rules is to protect the firm’s capital while identifying traders who can operate consistently and professionally.

In modern retail prop trading, traders are not hired as employees. Instead, they qualify for funded accounts through an evaluation or assessment process. During this phase, traders trade in a simulated environment that mirrors real market conditions using live price data. No real capital is placed into the market at this stage, but the firm closely monitors performance and risk behaviour. To pass the evaluation, a trader must usually reach a predefined profit target while staying within drawdown limits and daily loss rules. The evaluation is designed to test discipline rather than luck. Traders who succeed are upgraded to funded accounts, where profits become eligible for withdrawal under the firm’s payout structure.

The futures prop trading sector has expanded rapidly in recent years, with firms competing not only on funding size but also on rule clarity, payout access, and overall trader experience. Within this increasingly competitive environment, My Funded Futures has established itself as a specialist futures-only prop firm that focuses on structured evaluations, clear risk management, and a relatively accessible pathway to funded trading.

Who are My Funded Futures?

My Funded Futures provides traders with access to simulated futures trading accounts after they complete a qualification process. Like most retail prop firms, it does not place live capital into the markets on behalf of traders. Instead, traders trade in a simulated environment using real-time market data, and payouts are made by the firm based on performance and adherence to trading rules. The firm’s business model is built around identifying traders who can demonstrate consistency rather than short-term volatility. Traders pay for an evaluation, trade under defined risk parameters, and progress to funded status if they meet the criteria. The firm then shares profits with those traders who remain compliant and profitable over time. This model allows My Funded Futures to scale its operations while maintaining control over risk exposure.

My Funded Futures is a relatively young company, having emerged during the post-2020 expansion of online futures prop trading. While it does not have the same long operating history as some older prop firms, it has grown alongside the broader demand for funded futures trading opportunities. The firm has positioned itself as a straightforward alternative to more complex or heavily scaled prop firm models. Rather than emphasising aggressive marketing or constant promotional pricing, the firm has focused on building a clear and structured offering aimed at traders who value predictability and transparency. This positioning has helped it attract traders who prefer defined rules and a more measured approach to funded trading.

The firm operates primarily as an online business, serving traders globally and is based in the United States, its services are delivered digitally, with no requirement for traders to interact with physical offices or trading floors. All account management, evaluations, and support interactions are handled through online systems. This fully digital structure allows the firm to scale efficiently while keeping operational overhead relatively low. It also reflects the broader trend within the prop trading industry, where technology and remote access have replaced traditional in-house trading desks.

A defining characteristic of My Funded Futures is its exclusive focus on futures markets. The firm does not offer forex, equities, or cryptocurrency trading, which allows it to tailor its rules, risk parameters, and platform integrations specifically for futures traders. The trading environment is designed to reflect professional futures trading conditions, with access to widely used platforms and real-time market data. By supporting established trading software rather than proprietary platforms, My Funded Futures enables traders to operate using familiar tools, reducing the learning curve and minimising execution friction. This futures-only focus also simplifies rule enforcement and risk management. Futures markets have clearly defined contract specifications and margin requirements, making them well-suited to structured prop trading models.

As with many privately held prop firms, detailed financial information and internal metrics are not publicly disclosed. However, the firm maintains an identifiable online presence and has developed a growing user base within the futures trading community.

My Funded Futures reputation and community perception

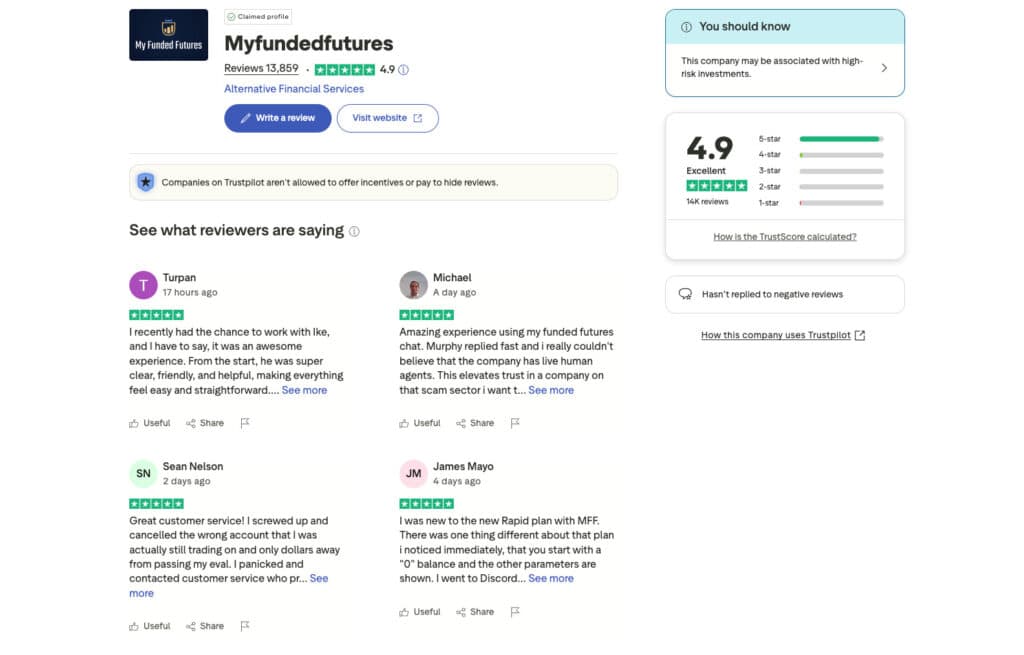

Within the futures trading community, My Funded Futures is generally viewed as a legitimate and structured prop firm and has over 13,800 reviews on Trustpilot with a rating of excellent, 4.9. It may not have the same level of brand recognition as some of the largest firms, but it has developed a reputation for clarity and consistency. Trader feedback suggests that payouts are processed reliably when rules are respected, though, as with all prop firms, individual experiences can vary. Issues that arise are often linked to misunderstandings around drawdown mechanics or withdrawal thresholds rather than arbitrary payment denials. Online discussions and reviews tend to highlight the firm’s straightforward rules and manageable evaluation structure. As with all prop firms, opinions vary based on individual outcomes, but the overall perception places My Funded Futures among the more methodical and rule-driven options in the futures prop trading space. For futures traders who value clarity, discipline, and a direct path from evaluation to funded trading, My Funded Futures represents a credible option within the broader prop trading ecosystem.

Why traders choose My Funded Futures

Choosing a prop trading firm is ultimately about alignment. Traders tend to perform best in environments where the rules, structure, and expectations match the way they already trade. My Funded Futures appeals to a particular group of futures traders because it offers a structured, clearly defined framework that prioritises consistency, transparency, and professional risk management over aggressive marketing or overly complex programmes.

One of the primary reasons traders are drawn to this prop firm is its exclusive focus on futures markets. By specialising in futures rather than attempting to support multiple asset classes, the firm is able to design its evaluation rules, drawdown mechanics, and account structures specifically around futures trading behaviour. For traders who already understand futures contract sizing, margin dynamics, and intraday volatility, this focus creates a more intuitive and predictable trading environment. My Funded Futures places a strong emphasis on clearly documented evaluation criteria, drawdown limits, and daily risk controls. Traders know exactly what is required to qualify and what behaviour will result in disqualification. This level of transparency allows traders to design and execute strategies with confidence, without constantly worrying about ambiguous or hidden conditions that can undermine performance.

The evaluation structure itself is a key reason many traders choose My Funded Futures. The firm’s qualification process is designed to reward steady, repeatable performance rather than one-off large trades. There is no pressure to trade every day, which allows traders to wait for high-quality setups that align with their strategy. This approach resonates with traders who value patience and precision over constant market engagement. The firm supports established futures trading platforms which allows traders to use tools they are already comfortable with, including custom indicators, order flow analysis, and advanced charting. For experienced traders, this continuity reduces execution errors and helps maintain consistency across personal and funded accounts.

A summary of the My Funded Future process.

Simply visit the My Funded Futures challenge dashboard and select an evaluation programme and demo account size that matches their goals. Before beginning, you are encouraged to review all rules and terms of use carefully, including guidance available through the firm’s community channels such as Discord. Once the challenge is selected, traders complete the signup process, subscribe to their chosen evaluation, and receive account credentials to begin trading. With credentials in hand, traders begin the evaluation phase by trading the simulated account using their preferred futures trading platform. My Funded Futures integrates with several popular platforms, such as Trading View, Tradovate and NinjaTrader giving traders the freedom to choose the interface and tools that suit their style best. A key appeal is the simplicity of the evaluation. Across all plans — including Core, Scale, and Pro — My Funded Futures uses a single evaluation model that emphasises disciplined performance rather than burdensome hurdles.

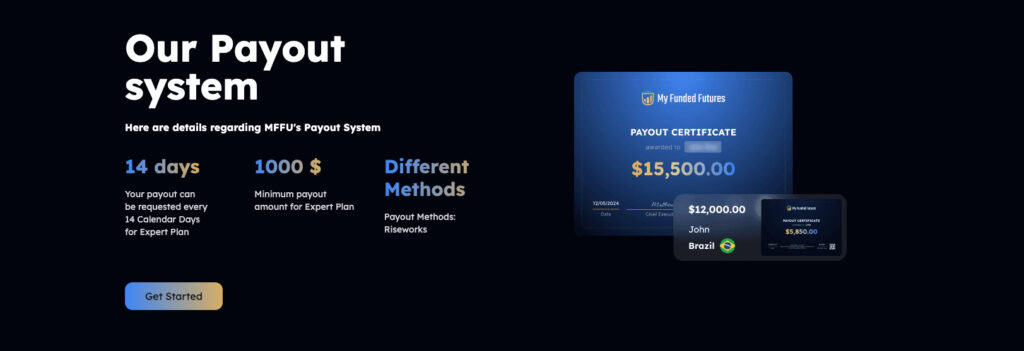

Once the evaluation rules are met, traders move into the funding stage. My Funded Futures offers different payout schedules depending on the plan selected. For Core and Scale plans, traders can request payouts weekly, while the Pro plan typically allows payouts every 14 days with a payout cap applied in certain tiers. Traders can request up to $100,000 in payout funds under the firm’s structure, with an 80/20 profit split in favour of the trader once funded.

Importantly, the program emphasis freedom once a trader is funded. On sim-funded accounts there are no daily loss limits or consistency requirements, giving traders flexibility in how they execute their strategies as long as overall risk rules are respected.

A more in-depth analysis of how My Funded Futures Evaluations and Qualifications Work

The evaluation and qualification system at My Funded Futures is designed to identify traders who can trade futures markets consistently while operating within clearly defined risk limits. Rather than focusing on speed or aggressive profit targets, the firm’s process is built around discipline, repeatability, and risk awareness, reflecting how professional trading performance is assessed in real-world environments.

The process begins when a trader selects an evaluation account size. Each account comes with predefined parameters that include a profit target, a maximum drawdown, and daily loss limits. These parameters are fixed from the outset, allowing traders to understand exactly what is required before placing their first trade. The evaluation is conducted in a simulated trading environment using real-time market data, which mirrors live futures market conditions without exposing real capital. During the evaluation phase, the trader’s primary objective is to reach the profit target while remaining fully compliant with all risk rules. There is no requirement to achieve the target within a specific number of days, which removes time pressure and discourages forced trading. Traders are free to trade only when their strategy presents valid opportunities, an approach that aligns well with traders who prioritise patience and selectivity.

Risk management plays a central role throughout the evaluation. Each account has a maximum drawdown limit that defines the point at which the evaluation is failed if losses exceed that threshold. This drawdown is closely monitored and visible within the trader dashboard, allowing traders to track remaining risk in real time. By enforcing this limit consistently, this ensures that traders demonstrate control over downside risk rather than relying on recovery trades or excessive leverage. In addition to the overall drawdown, daily loss limits are applied to prevent excessive losses within a single trading session. These limits are designed to reduce the impact of emotional decision-making, such as revenge trading after a losing streak. Traders who exceed the daily loss limit are disqualified from the evaluation, regardless of overall profitability, reinforcing the principle that risk discipline is non-negotiable.

Throughout the evaluation period, traders have access to a performance dashboard that displays key metrics such as realised profit, unrealised drawdown, daily loss usage, and rule compliance status. This transparency is an important feature of the system, as it allows traders to make informed decisions and adjust behaviour before a violation occurs. The outcome of the evaluation is determined objectively by these metrics rather than subjective judgement.

Once the trader reaches the profit target while respecting all risk rules, the evaluation is considered complete. The account is then reviewed for compliance, and assuming no violations are found, the trader is qualified and upgraded to a funded account. This transition is designed to be smooth, with the funded account operating under a very similar set of rules to the evaluation. In the funded stage, traders continue to trade under the same core risk framework, but profits generated now become eligible for withdrawal according to the firm’s payout policies. The qualification process therefore acts not only as a gateway to funding but also as a preparation phase that reinforces the habits required to remain profitable once real payouts are at stake.

How Payments and Withdrawals Work at My Funded Futures

Understanding how payments and withdrawals work is essential for any trader considering a prop trading firm, as payout mechanics ultimately determine whether trading performance can be converted into real income. My Funded Futures operates a performance-based payment system that is deliberately structured, rule-driven, and closely tied to ongoing risk compliance rather than short-term profitability alone. Essentially, daily payouts are available and the profit share is based on an 80/20 split.

At My Funded Futures, withdrawals are only available once a trader has successfully completed the evaluation phase and is trading a funded account. During the evaluation stage, all activity is used purely to assess consistency, risk management, and rule adherence. Even if an evaluation account shows substantial profit, no withdrawals are permitted at this point. This separation reinforces the firm’s model, where payments are reserved for traders who have demonstrated they can operate within the firm’s framework over time.

Once a trader qualifies and transitions into a funded account, profits generated become eligible for withdrawal, provided the account remains compliant with all risk rules. Payments are calculated based on net realised profits, and the trader receives a defined share according to the firm’s profit-splitting arrangement which with this firm is upto 80%, with traders being rewarded for sustainable, rule-compliant performance rather than isolated winning streaks.

A key feature of their payment system is the relationship between withdrawals and drawdown, which is inherently similar to other prop firms. Traders cannot withdraw profits in a way that would place the funded account below its required drawdown limit. This means that although an account may appear profitable on paper, only a portion of those profits may be immediately withdrawable. The remaining balance effectively acts as a buffer to ensure the account stays within risk parameters after a payout is processed. This structure encourages traders to think in terms of long-term account health rather than extracting profits as quickly as possible.

Withdrawal requests are made through the dashboard, where traders can view their realised profits, available withdrawal amounts, and eligibility status. This transparency is central to the system, as it allows traders to plan withdrawals with a clear understanding of how much can be taken without breaching rules. Requests are then reviewed to confirm that all trading activity during the payout period complied with drawdown limits, daily loss rules, and position sizing requirements. Once a withdrawal request is approved, payments are processed through the firm’s designated payment methods. Processing times can vary depending on administrative workload and payout volume, but traders who follow the rules closely generally report predictable and timely payments. As with all prop firms, delays or rejections are most commonly linked to rule violations or misunderstandings around drawdown mechanics rather than arbitrary withholding of funds.

An important aspect of their payout model is that funded accounts remain subject to the same risk rules even after withdrawals are made. Traders cannot relax risk discipline after receiving a payout, as the account must continue to operate within defined limits to remain active. This reinforces the idea that payouts are part of an ongoing performance relationship rather than a one-time reward.

It is also worth noting that, like other modern prop firms, they operate using simulated trading environments. Payments are not derived from profits generated by live market execution but are instead performance-based rewards paid by the firm. Understanding this distinction helps set realistic expectations and highlights the importance of fully understanding the firm’s rules before trading.

In practical terms, traders who experience smooth and consistent withdrawals tend to approach payouts strategically, by maintaining healthy buffers above drawdown limits, request withdrawals at appropriate intervals, and prioritising consistency over maximum short-term extraction. Traders who encounter difficulties often do so because of aggressive risk-taking or misinterpretation of how withdrawals interact with drawdown rules.

In reality, the payments and withdrawals system at My Funded Futures reflects the firm’s broader philosophy. It is designed to reward disciplined futures traders who can manage risk, follow rules, and sustain performance over time, offering a clear and structured pathway from funded trading to real-world payouts.

Please note:

All information included within this review is correct at the time of publication. Changes made by the prop firm can be made without prior knowledge.