The growth of online proprietary trading has fundamentally changed how retail traders access capital. Futures traders in particular have increasingly turned to prop firms as a way to trade larger size, reduce personal financial risk, and operate within structured risk frameworks. As this sector has expanded, so too has the range in quality between firms. Some focus heavily on marketing while others prioritise operational clarity, payout reliability, and trader experience.

Take Profit Trader has emerged as one of the more widely discussed futures-only prop firms in this evolving landscape. Founded in the early 2020s, the company has positioned itself as a trader-focused alternative to more complex or restrictive funding models, placing emphasis on simplicity, speed, and transparency.

The fact is that futures markets attract traders because of their liquidity, centralised exchanges, and defined contract specifications. However, trading futures effectively often requires more capital than many retail traders are comfortable risking personally. Prop firms address this by offering traders access to simulated capital allocations once they demonstrate consistency and discipline through an evaluation process. In return, firms impose risk rules designed to protect their capital and ensure traders behave in a controlled, professional manner. The most successful prop firms are those that balance risk management with enough flexibility for traders to execute their strategies without constant friction.

Take Profit Trader’s business model sits firmly within this framework, with a clear focus on futures trading rather than attempting to support multiple asset classes.

Who are Take Profit Trader?

Take Profit Trader is a prop trading firm focused on providing capital to individual traders who demonstrate profitable and disciplined trading performance, specifically in futures markets. Rather than functioning as a traditional broker where traders risk their own capital, Take Profit Trader allows traders to earn access to funded accounts by passing a structured evaluation. Once funded, traders can withdraw profits under the firm’s payout policies. The firm operates a business model common among modern prop firms: individuals pay to enroll in an evaluation, meet the performance criteria, and then get access to firm capital. The primary differentiators that Take Profit Trader promotes include day-one payout access, clear trading rules, and a focus on futures contracts execution with industry-standard platforms

Take Profit Trader was founded in 2021, making it a relatively new entrant in the prop trading industry. Its founder and CEO is James Sixsmith, a former professional hockey player turned trader and entrepreneur. Sixsmith’s vision for Take Profit Trader grew from his experience in markets and a desire to create a trader-friendly funding environment with transparent rules, fast payouts and supportive community resources. On the firm’s own website, Sixsmith describes a personal journey from professional sport to trading and then to building a firm that avoids the “snake oil” salesmanship he observed in parts of the trading education and prop trading industry. His stated mission has involved offering quality free educational resources and strong customer support as core differentiators.

Since its inception, Take Profit Trader has expanded its staff and community presence rapidly and now lists a team size typically between 51 and 200 employees, according to public business profiles. There’s also active public engagement from the founder via interviews, livestreams, and industry discussions, which illustrates a deliberate effort to communicate directly with the trading community.

The firm is headquartered in Orlando, Florida, in the United States, which has become a popular base for financial services and trading-related businesses, partly due to its business-friendly environment and growing fintech presence. The firm operates as a privately held company and does not publish public financial statements, which is standard for most prop trading firms.

The company maintains an identifiable corporate footprint, including formal business registration and accreditation with the Better Business Bureau. While BBB accreditation is not a guarantee of quality, it does indicate that the firm has engaged with formal complaint resolution processes and maintains a degree of operational transparency.

From an operational standpoint, the firm functions entirely online, serving traders globally. There are no physical trading floors or in-person offices for traders, with all interaction handled through digital platforms, support channels, and community spaces.

So what does Take Profit Trader offer?

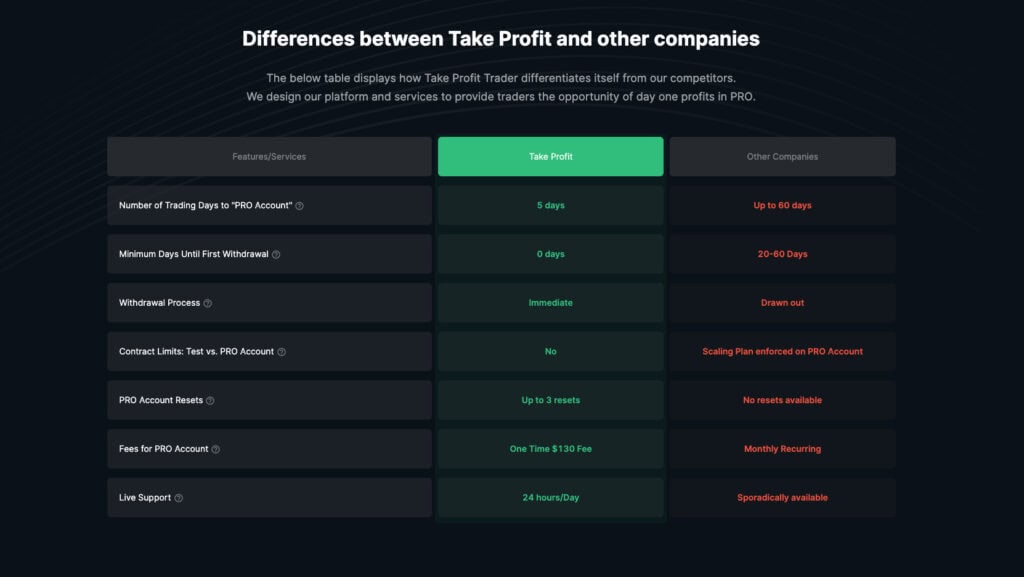

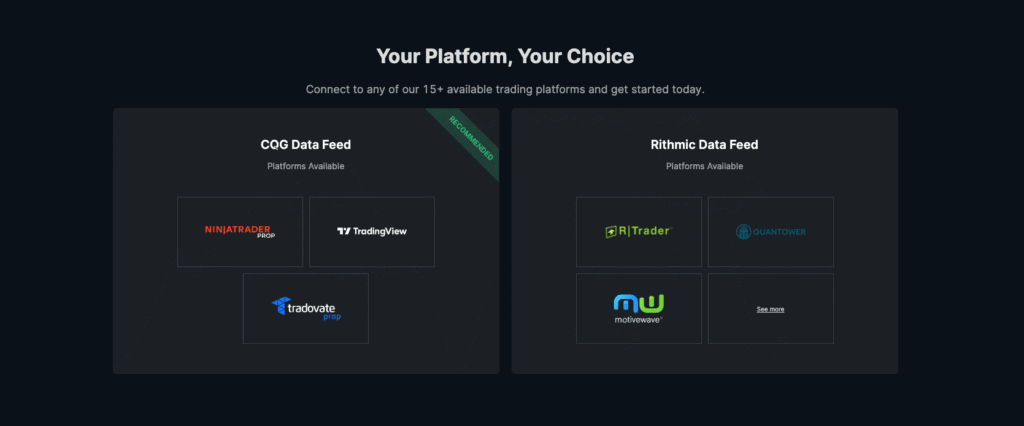

Take Profit Trader’s core service is structured around futures market funding, which includes evaluation challenges that, once passed, lead to funded accounts where traders can scale and withdraw profits. The company emphasises a model where traders can access payouts from their funded accounts from day one, which is a notable contrast to some competitors that impose waiting periods or payout windows. The firm operates multiple trading platforms via data feeds such as Rithmic and CQG, which are well-known in the futures trading community for their execution quality and market depth. They support a broad range of futures contracts including equity indices, commodities, interest rate products and currencies, allowing traders to work with instruments they are familiar with and build scalable strategies.

When evaluating a prop trading firm, the real question is not how aggressive the marketing is, but how the actual offering aligns with real trading behaviour. Take Profit Trader has built its proposition around a small number of clearly defined offers that are designed to reduce friction between traders and performance. Rather than layering multiple programs or complex upgrade paths, the firm concentrates on making each core component of its offering understandable, accessible, and operationally consistent. At the center of their offer is funded access to futures markets through a structured evaluation model. The evaluation accounts offered by Take Profit Trader are structured to reflect realistic trading conditions rather than artificial challenges designed purely to generate repeat fees. Profit targets and drawdown limits are set in a way that encourages disciplined execution rather than gambling behaviour. Traders are expected to show consistency and respect for risk, but they are not forced into narrow trading windows or unrealistic daily performance requirements, which allows a wide range of trading styles to function, provided they are compatible with intraday futures trading.

Once a trader successfully completes the evaluation phase, they offer a direct transition into a funded account. This is a key part of the firm’s value proposition with the funded environment closely mirroring the evaluation conditions, which reduces the psychological disruption that can occur when traders suddenly face a new set of rules after passing. By maintaining continuity, the firm encourages traders to continue executing the same strategies that proved successful during the evaluation rather than increasing risk unnecessarily. One of the most frequently highlighted aspects of their offer is its approach to payouts. The firm promotes early and accessible profit withdrawals, positioning itself against competitors that impose extended waiting periods or restrictive payout schedules. For many traders, the ability to request payouts without months of delay is a defining feature, as it validates the purpose of prop trading itself. Reviews and trader commentary often cite payout speed as a major reason for choosing the firm, particularly among traders who rely on prop trading income rather than treating it as an experiment.

The profit-sharing structure is designed to reward traders for consistent performance rather than one-off gains. While exact percentages and thresholds vary depending on account type, the underlying principle is that traders keep a significant share of the profits they generate once eligibility criteria are met. This creates an incentive alignment between trader and firm, as both benefit from sustainable profitability rather than short-term volatility.

Another important element of Take Profit Trader’s offer is platform access. The firm integrates with established futures trading platforms rather than proprietary software. This allows traders to use tools they are already familiar with, including advanced charting, order flow analysis, and custom indicators. For experienced futures traders, this is not a minor detail. Platform familiarity reduces execution errors, supports faster decision-making, and removes the need to adapt strategies to unfamiliar interfaces. The range of futures instruments available through Take Profit Trader supports both micro and standard contracts across major asset classes. This flexibility allows traders to scale position size gradually and adapt risk to their account parameters. Traders who prefer micros for precision and risk control can operate alongside those who trade standard contracts for higher exposure, provided they remain within the firm’s risk framework.

Risk management is embedded into every aspect of the offer. Maximum drawdown rules, daily loss limits, and contract size restrictions are not presented as optional guidelines but as core operating conditions. While some traders view these constraints as limitations, others recognise them as guardrails that reinforce professional trading habits. Take Profit Trader’s offer is clearly aimed at the latter group, traders who value structure as a way to sustain long-term performance.

Scaling opportunities are also part of the firm’s broader offering, though they are intentionally performance-driven rather than automatic. Traders who demonstrate consistency over time may gain access to larger account sizes or increased trading capacity. This creates a progression pathway that rewards discipline rather than speed. For traders with long-term ambitions, this aspect of the offer can be as important as initial funding.

Beyond trading accounts themselves, Take Profit Trader positions its support infrastructure as part of its overall value. Customer support, rule documentation, and account management systems are designed to reduce ambiguity. While no support operation is flawless, the firm’s emphasis on accessibility and responsiveness is reflected in a large proportion of positive trader feedback. For many traders, knowing that issues can be resolved without prolonged uncertainty contributes significantly to overall confidence in the firm.

It is also worth noting that their offer is deliberately specialised. By focusing exclusively on futures, the firm avoids the complexity of supporting multiple asset classes with differing market structures. This specialisation allows for tighter integration with futures data feeds, clearer rule enforcement, and a more consistent trader experience. Traders seeking forex, equities, or crypto exposure will need to look elsewhere, but for futures-focused traders, this narrow scope can be an advantage rather than a drawback. Taken together, what they offer is not a promise of easy profits or guaranteed success. Instead, it provides a structured environment in which traders can apply proven strategies with access to capital, defined risk limits, and a clear path to withdrawals. The firm’s appeal lies less in novelty and more in execution, delivering a model that aligns closely with how disciplined futures traders already think and operate. For traders who understand futures markets, respect risk management, and value clarity over complexity, Take Profit Trader’s offering represents a coherent and well-defined proposition within the modern prop trading landscape.

How to Get Started With Take Profit Trader

Getting started with Take Profit Trader is designed to be a straightforward process, particularly for traders who already have some familiarity with futures markets and professional trading platforms. The firm has intentionally kept onboarding simple, with clear stages that move traders from registration to evaluation and, ultimately, to funded status.

The first step begins on the Take Profit Trader website, where traders create an account by providing basic personal information and setting up login credentials. This initial registration does not require proof of trading history or prior performance. Instead, the firm allows traders to demonstrate their ability directly through its evaluation process. Once the account is created, traders gain access to their client dashboard, which acts as the central hub for managing evaluations, viewing rules, and tracking performance. After registration, traders choose an evaluation account that aligns with their experience level and risk tolerance. They offer multiple account sizes, allowing traders to select a starting point that fits their preferred contract sizing and drawdown comfort. This decision is important, as the evaluation rules scale with account size. More experienced traders often opt for larger accounts to maximise potential returns, while those newer to prop trading may choose smaller accounts to focus on consistency and rule compliance.

Once an evaluation account is selected, traders complete the checkout process and receive access to the trading environment. At this stage, traders connect their account to one of the supported futures trading platforms. Because Take Profit Trader integrates with established platforms rather than proprietary software, many traders find this step familiar. Platform credentials and data feed instructions are provided through the dashboard, allowing traders to begin trading without unnecessary setup delays.

With platform access in place, the evaluation phase begins. During this stage, traders trade simulated futures markets using real-time data, aiming to reach the defined profit target while respecting all risk parameters. These include maximum drawdown limits, daily loss thresholds, and contract size rules. The evaluation is not time-restricted in the sense of forcing daily performance, which allows traders to trade at their own pace. This structure encourages disciplined execution rather than impulsive overtrading.

Throughout the evaluation, traders can monitor their progress directly from the dashboard. Metrics such as unrealised drawdown, realised profit, and remaining risk are updated regularly, helping traders stay aware of their standing. This transparency is particularly valuable, as it reduces the likelihood of accidental rule violations and allows traders to adjust behaviour before problems arise.

Once the evaluation criteria are met and all rules have been respected, the account is reviewed and upgraded to funded status. This transition is typically smooth, with minimal changes to the trading environment. Funded accounts operate under similar conditions to evaluations, which helps traders maintain the same strategy and mindset that led to success in the first place. There is no requirement to re-learn a new rule set or adapt to drastically different conditions.

After becoming funded, traders can begin working toward profit withdrawals in line with Take Profit Trader’s payout policies. One of the firm’s distinguishing features is that traders are not required to wait extended periods before becoming eligible for payouts. As profits are generated and withdrawal criteria are met, traders can request payouts directly through the dashboard. This process reinforces the practical goal of prop trading, which is to convert trading performance into real income rather than hypothetical results.

Ongoing account management continues through the same dashboard used from the beginning. Traders can monitor performance, manage withdrawals, communicate with support, and review rules at any time. For traders who remain consistent and disciplined, Take Profit Trader also provides pathways for growth, allowing access to larger account sizes over time.

Overall, starting with Take Profit Trader follows a logical progression that mirrors professional trading workflows. Traders register, select an evaluation that matches their goals, demonstrate consistency under defined risk rules, and then transition into a funded environment with access to withdrawals. For futures traders who value clarity, structure, and a direct path from performance to payout, the onboarding process is designed to remove unnecessary obstacles and keep the focus on trading itself.

Understanding the Take Profit Trader Qualification System

The qualification system used by Take Profit Trader is designed to assess whether a trader can operate consistently within defined risk parameters while generating profits in futures markets. Rather than relying on theoretical assessments or historical performance records, the firm evaluates traders directly through live market participation in a simulated environment. This approach reflects how professional trading performance is measured in practice, with outcomes determined by behaviour under real market conditions rather than promises or prior claims.

At the centre of the qualification system is the evaluation account. This account functions as a proving ground where traders demonstrate discipline, risk awareness, and strategy execution. The evaluation is not intended to reward aggressive or impulsive trading. Instead, it is structured to identify traders who can grow an account steadily while respecting predefined limits. From the firm’s perspective, these limits exist to protect capital, but from the trader’s perspective, they act as guardrails that reinforce professional habits.

The primary objective during qualification is to reach a predefined profit target. This target varies depending on the account size selected at the start of the evaluation, but it is always fixed and known in advance. Traders are not required to achieve this target within a specific number of days, in fact, in as little as 5 days, which removes time pressure and discourages overtrading. This open-ended structure allows traders to trade only when conditions align with their strategy, rather than feeling forced to trade daily in pursuit of arbitrary deadlines.

While profit generation is necessary, it is not sufficient on its own. Risk management plays an equally important role in qualification. The evaluation account includes a maximum drawdown limit, which represents the largest allowable loss before the account is disqualified. This drawdown is typically calculated dynamically, meaning it adjusts as the account balance changes. Traders must therefore remain aware not only of their profit and loss but also of how close they are to breaching risk limits at any given moment. This dynamic structure mirrors professional risk oversight and encourages constant awareness of account health.

In addition to the overall drawdown limit, the qualification system includes daily loss constraints. These limits are designed to prevent excessive losses within a single trading session. Enforcing daily risk boundaries discourages revenge trading and emotional decision-making following losses, which is an oft seen issue with novice traders. Those traders who exceed these limits do not qualify, regardless of whether they are close to the profit target, reinforcing the idea that risk discipline is non-negotiable. Contract size restrictions are another component of the qualification framework. These limits control how many contracts a trader can hold at once, scaling with account size. The purpose is not to restrict opportunity, but to ensure that position sizing remains proportional to account capacity. Traders who attempt to accelerate qualification by trading oversized positions often find themselves violating risk rules, which reinforces the firm’s preference for measured, repeatable performance. Throughout the qualification period, traders have access to real-time performance metrics via the dashboard, which includes visibility into current profit or loss, remaining drawdown, and compliance with daily limits. This transparency is a critical part of the system, as it allows traders to make informed decisions during the evaluation rather than guessing where they stand and in fact, many traders view this clarity as one of the strengths of the qualification process, as it reduces the likelihood of accidental rule breaches.

Once a trader reaches the profit target while respecting all risk parameters, the evaluation is considered complete. At this point, the account is reviewed for compliance, and assuming no violations are found, the trader is upgraded to a funded account. Importantly, the transition from evaluation to funded status does not introduce a radically different rule set. The funded account operates under similar risk constraints, which helps traders maintain continuity in strategy and execution. This consistency between qualification and funded trading is a deliberate design choice. In some prop firm models, traders pass an evaluation only to encounter stricter or unfamiliar rules once funded, which can disrupt performance; however, Take Profit Trader’s system aims to minimise this disruption by ensuring that success during qualification is directly transferable to the funded environment.

The qualification system is therefore less about passing a challenge and more about demonstrating suitability for a structured trading environment. Traders who succeed are typically those who already trade with discipline, understand futures market dynamics, and are comfortable operating within defined risk limits, and in reality, those who struggle often do so not because the system is excessively difficult, but because it exposes weaknesses in risk control or emotional discipline.

How Payments and Withdrawals Work at Take Profit Trader

Payments are one of the most important considerations for any trader evaluating a prop trading firm. Profit targets, evaluations, and platforms matter, but the real test of a prop firm’s credibility is whether traders can reliably convert performance into actual income. Take Profit Trader has built much of its reputation around the accessibility and speed of its payment system, positioning payouts as a central part of its overall offer rather than an afterthought.

One of the defining features of their payment model is that traders do not need to wait for extended periods before becoming eligible to request withdrawals. Unlike some prop firms that impose minimum trading day requirements or multi-week holding periods, Take Profit Trader allows traders to access payouts on day one. This approach appeals strongly to traders who view prop trading as a source of real income rather than a long-term simulation exercise.

Payments are calculated based on the net profits generated in the funded account, subject to the firm’s profit-sharing arrangement. While exact percentages depend on account type and current policies, the underlying structure is designed so that traders retain a substantial portion, 80% of the profits they generate once payout thresholds are met. This aligns the firm’s incentives with trader performance, as this benefits most when traders are consistently profitable rather than when they churn through evaluations.

To request a payout, traders use the dashboard, which serves as the central management interface for funded accounts. From this dashboard, traders can see their realised profits, available withdrawal amounts, and payout eligibility status. This visibility is a key part of the payment system, as it allows traders to understand exactly when and how much they can withdraw without relying on guesswork or manual calculations.

When a payout request is submitted, it enters a review process to ensure that all trading rules have been respected and that profits were generated in compliance with risk limits. This review is a standard safeguard across the prop trading industry and is intended to prevent rule violations from being rewarded retroactively. Most traders who operate within the rules report smooth payout processing, while issues tend to arise when there is ambiguity around drawdown breaches or daily loss limits.

Once approved, payments are typically processed promptly. Many trader reviews highlight fast turnaround times as a positive aspect of Take Profit Trader’s operations, with withdrawals often completed within a short timeframe. While processing times can vary depending on volume and administrative factors, the firm’s general reputation for payout speed has played a significant role in building trust within the futures trading community.

An important aspect of the payment system is that funded accounts must remain within drawdown limits even after profits are generated. Traders cannot withdraw funds in a way that would place the account in violation of risk rules. This means that not all profits may be immediately withdrawable if doing so would reduce the account balance below required thresholds. This structure encourages traders to think in terms of account health rather than treating profits as isolated windfalls.

Over time, traders who remain consistent and compliant may gain access to higher withdrawal limits or larger account sizes, depending on the firm’s scaling policies. While payments themselves are not guaranteed, the pathway to increased earning potential is directly linked to sustained performance and disciplined execution rather than short-term gains.

It is also worth noting that, like all prop firms, Take Profit Trader operates within a simulated trading environment. Payments are not a share of profits from live market trades but are instead performance-based rewards paid by the firm. Understanding this distinction helps set realistic expectations and reinforces the importance of carefully reading payout rules before trading.

In practice, the payment system at Take Profit Trader is designed to be predictable rather than flashy. Traders who follow the rules, manage risk carefully, and generate consistent profits generally find the withdrawal process straightforward. Those who struggle with payouts often do so because of misunderstandings around drawdown mechanics or eligibility conditions rather than because payments are arbitrarily withheld.

For futures traders considering Take Profit Trader, the payment structure reflects the firm’s broader philosophy. It rewards discipline, transparency, and repeatable performance, offering traders a clear mechanism for turning funded trading results into real-world income while maintaining the risk controls necessary to support a sustainable prop trading model.

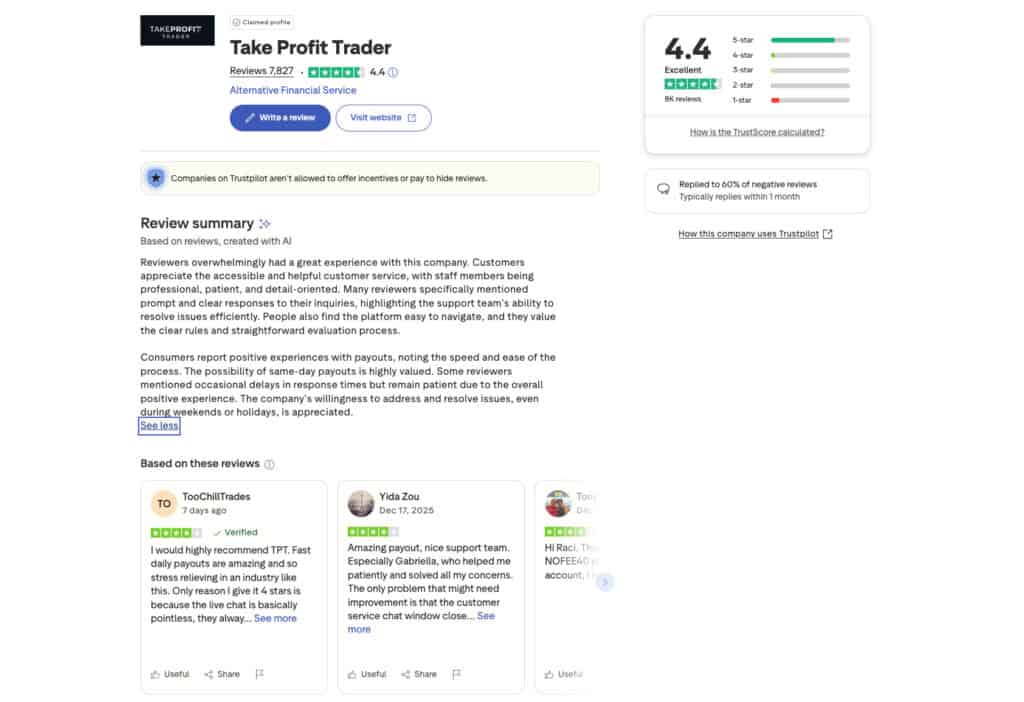

What is the trader perception of Take Profit Trader

Payout access is one of the most closely scrutinised aspects of any prop firm. Take Profit Trader has built much of its brand recognition around relatively fast access to withdrawals, including the ability to request payouts early in the funded account lifecycle. Public reviews and testimonials frequently highlight payout speed as a positive aspect of the firm. Many traders report receiving withdrawals promptly, which contributes significantly to perceptions of legitimacy and trust. In the prop trading space, where scepticism is common, consistent payout execution is often the strongest form of credibility.

Please note:

All information included within this review is correct at the time of publication. Changes made by the prop firm can be made without prior knowledge.